You just closed your Series A and everything feels like it’s moving fast in the right direction. But behind the momentum, many founders hit avoidable financial traps that stall growth and shake investor confidence. From rising burn rates to confusing board metrics, this guide breaks down the five biggest mistakes startups make after funding and shows how CFO services can help you stay focused, in control, and on track to scale.

You’ve just closed your Series A funding. The press release is live, the LinkedIn post is gaining traction, and your bank account has never looked stronger. It’s a major milestone—one that brings energy, visibility, and resources.

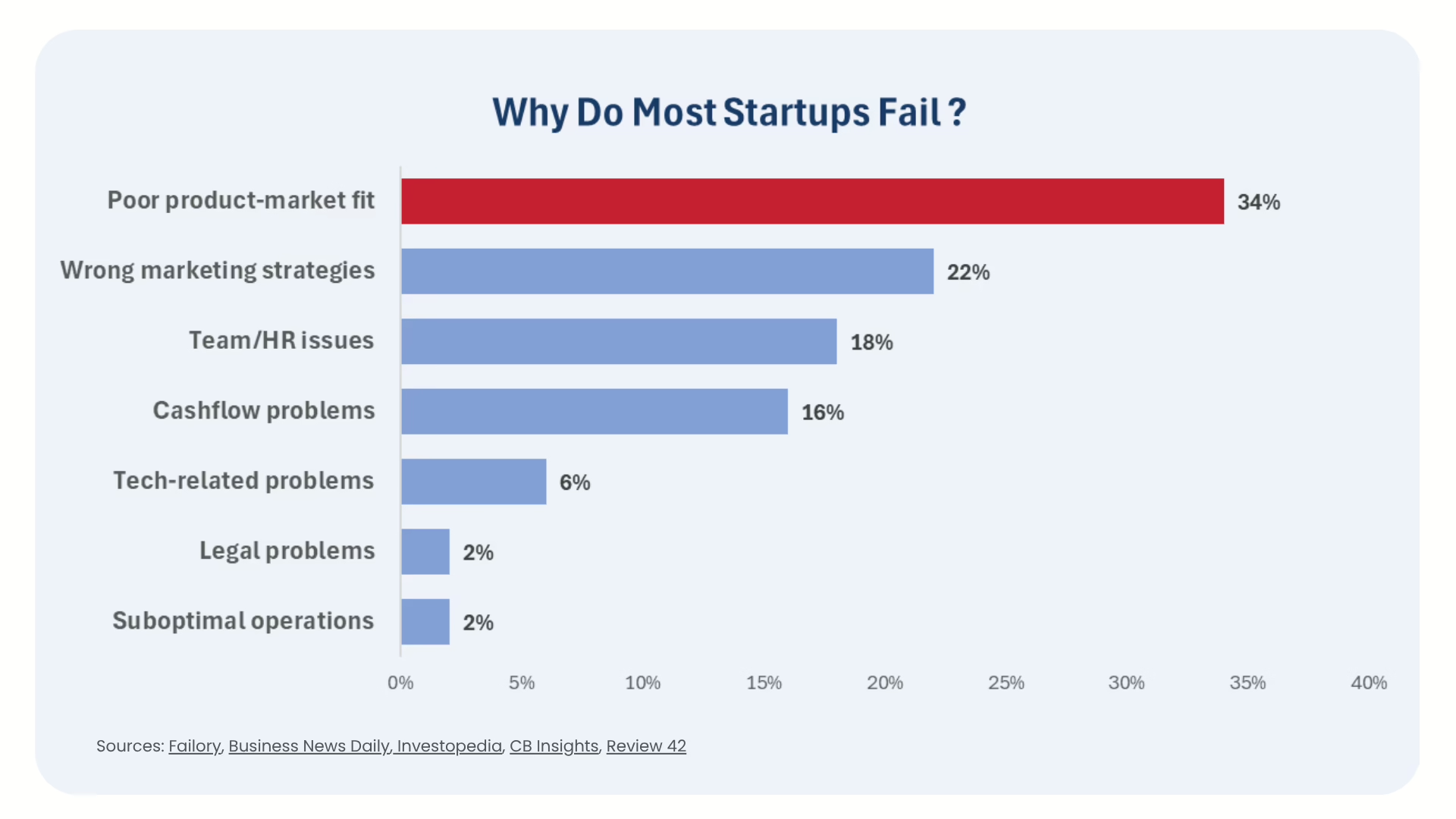

However, the data paints a more sobering picture. According to Failory, 75% of VC-backed startups never return capital to investors. Even more concerning, 38% fail because they run out of cash—often due to preventable financial missteps.

As founders who have successfully navigated post-funding growth, we’ve seen how quickly financial blind spots can derail even the most promising companies. The good news? These failures are avoidable. By engaging expert CFO services early, you can gain the structure, discipline, and foresight needed to stay focused, stay in control, and scale with confidence.

Post-Funding Reality Check

Securing Series A funding also means entering a new, more demanding growth phase. At this stage, startups must demonstrate scalable traction while managing increasingly complex operations.

Studies show that after Series A funding:

- 65% of companies struggle with cash flow management in the first 18 months

- 65% of start-ups have a runway of six months or less, and 41% even have less than three months

These dramatic shifts underscore the importance of structured financial oversight. Let’s explore five critical financial pitfalls—and how CFO services help you avoid them.

Trap 1: Burn Rate Explosion

What happens:

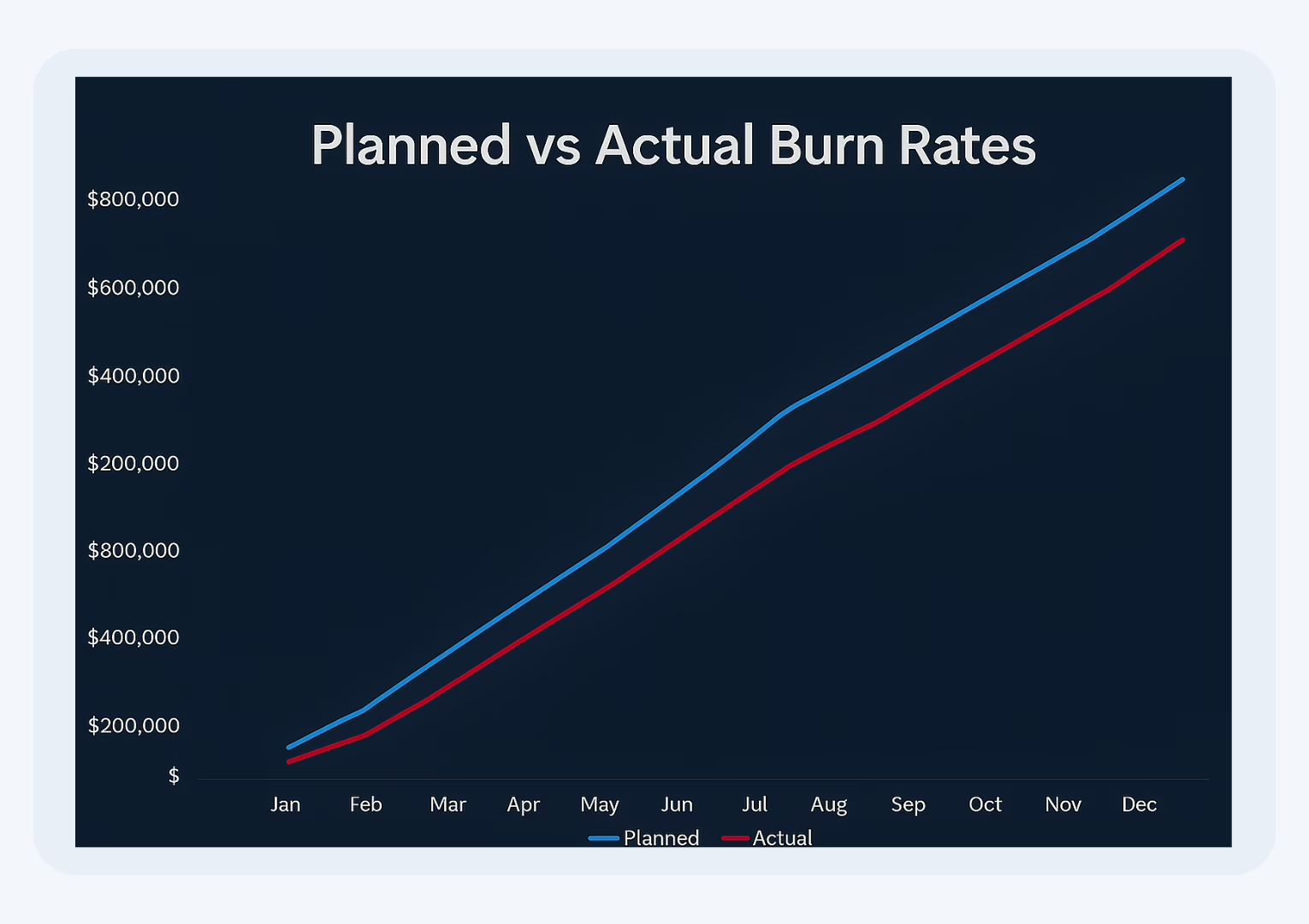

After receiving Series A funding, many startups increase spending rapidly. New hires, upgraded perks, and ballooning marketing and software budgets can cause burn rates to rise sharply. The lean startup mindset fades, and runway begins to disappear.

The real cost

This isn’t just about burning through money faster, it’s about runway. That $12M Series A that should last 36 months? At an inflated burn rate, you’re looking at 18 months or less before you need Series B.

The data:

- Post-Series A startups typically scale burn by approximately 3x over prior stage

- Series A startups typically have burn rates of $200,000 to $400,000 per month compared to seed-stage rates of $50,000 to $100,000

- The average monthly burn rate for Series A companies is just under $400,000

How to avoid it:

- Set burn rate targets linked to real growth milestones

- Use rolling 13-week cash flow forecasts and update them every week

- Align hiring decisions with onboarding capacity, not just budget

Trap 2: KPI Chaos

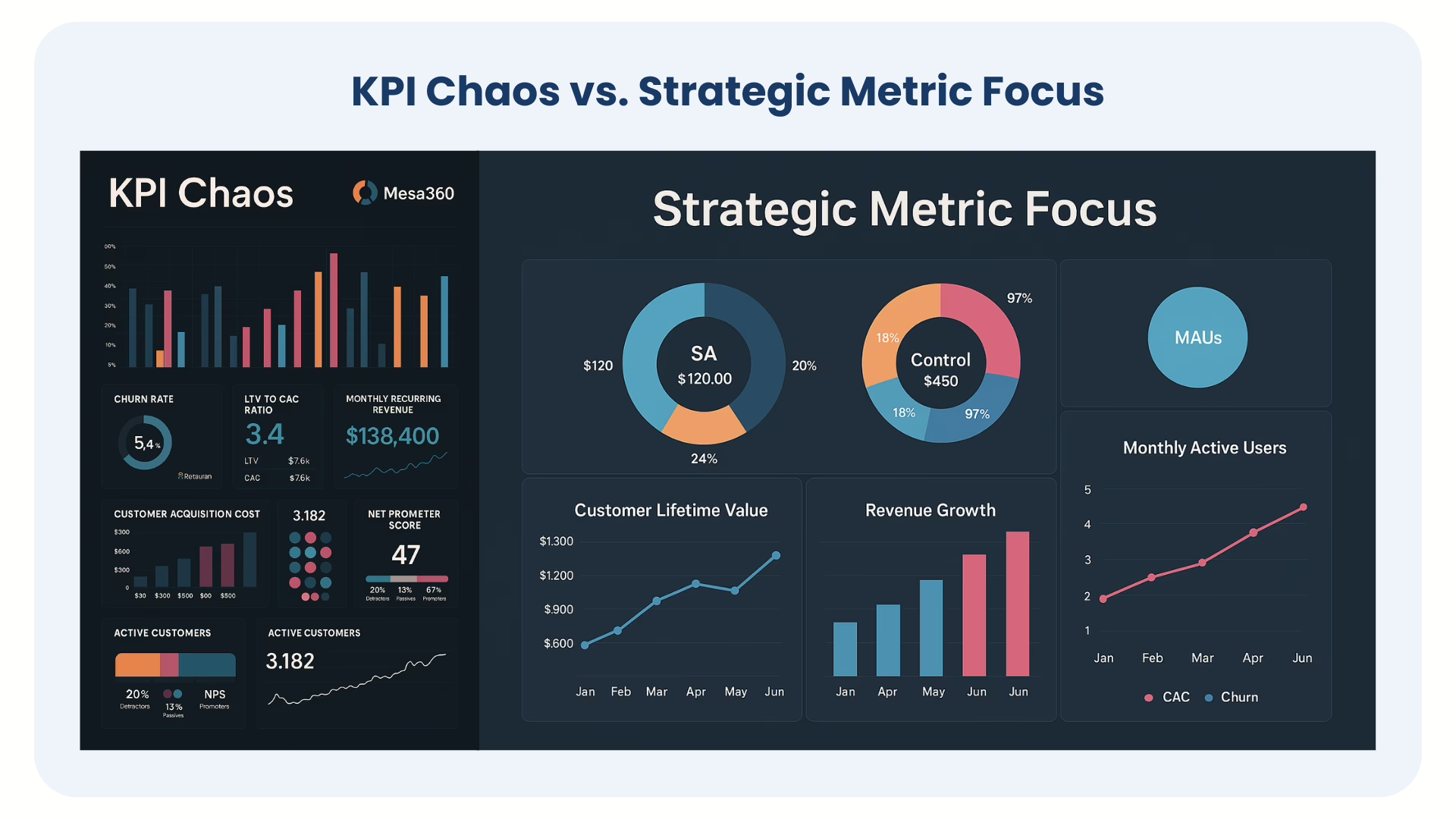

What happens:

Before funding, you tracked a handful of core metrics. Now you’re tracking 20 or more. The board wants endless reports. Teams chase numbers without knowing which truly matters.

The hidden danger

When everything is a priority, nothing is. Teams waste cycles optimizing metrics that don’t drive growth while missing the warning signs that matter.

The data:

- The average SaaS company tracks 15-20 metrics regularly, with some tracking 30+ KPIs

How to avoid it:

- Pick your “North Star 5” metrics that directly drive success

- Build a hierarchy for your metrics including board-level, operational, and exploratory

- Review these metrics monthly with clear discussions on what’s working and what isn’t

Trap 3: Forecasting Fantasy

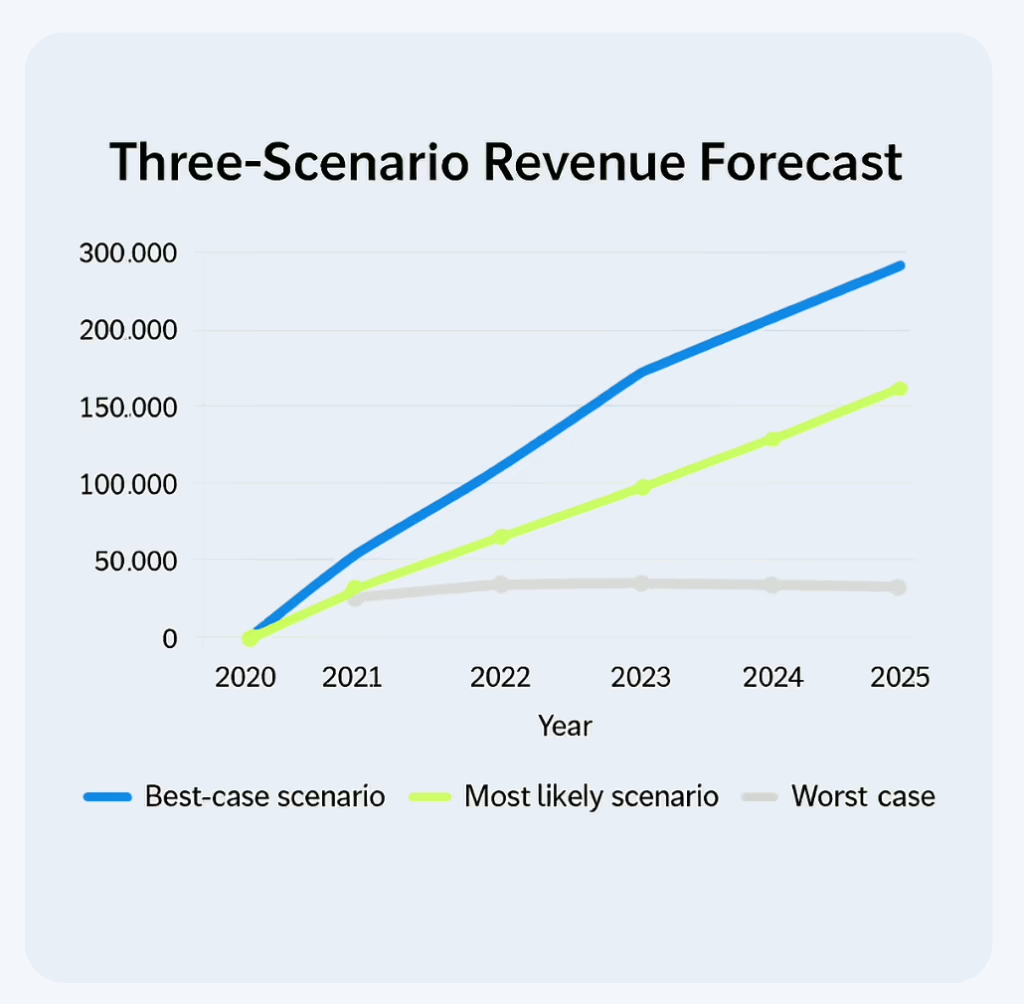

What happens:

You feel pressure to show a clear revenue path. So, you build optimistic forecasts that are guesses more than models. This leads to over hiring, poor planning, and losing investor trust.

Why this kills companies: Inaccurate forecasting doesn’t just disappoint investors, it leads to poor hiring decisions, cash shortfalls, and strategic pivots that could have been avoided.

The data:

- Only approximately 45% of sales leaders feel highly confident in their company’s forecasting accuracy

- The average company forecasts a growth rate of 522% in revenue for their first year, which often proves optimistic

How to avoid it:

- Build three-scenario models: best case, most likely, and worst case and plan spending for the worst case

- Use both rolling 13-week cash flow forecasts and longer 52-week strategic forecasts

- Track your forecast accuracy monthly and use it to improve

Trap 4: Scaling Without Infrastructure

What happens:

You grow from 10 to 50 people, but your systems are still stuck in startup mode. Approval flows are unclear, processes are manual, and software subscriptions pile up unchecked.

The data:

- 91 percent of fast-growing startups face “process debt” which means inefficiencies caused by outgrowing their systems

Real impact: We’ve seen companies lose $47,000 a month from duplicate payments, rogue software costs, and messy workflows. Not one big failure, just dozens of small ones compounding.

How to avoid it with the Infrastructure Upgrade Checklist:

- Financial controls: Implement approval hierarchies and spending limits

- Systems audit: Evaluate whether your current tools can handle 3x growth

- Process documentation: Create playbooks for recurring financial operations

- Regular financial health checks: Monthly comprehensive reviews, not just revenue tracking

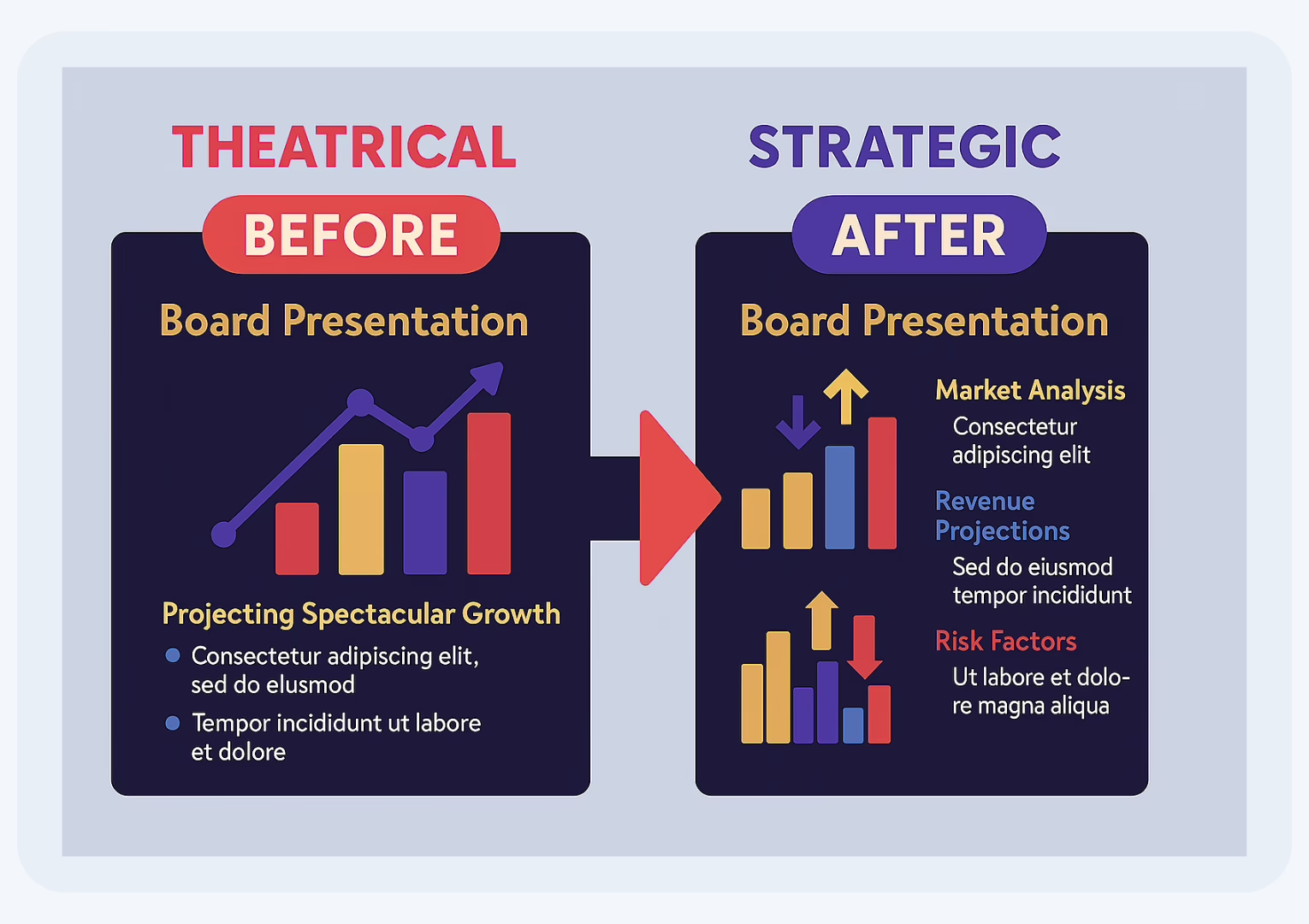

Trap 5: Board Meeting Theater

What happens:

Founders spend weeks crafting polished slides that hide problems instead of addressing them. Hard topics get avoided until it’s too late.

The data:

- Research shows that founders often feel pressure to ‘sugarcoat bad news’ in board meetings due to expectations to project an image of success, according to Forbes

The strategic approach:

- Lead your board meetings with transparency about challenges, not just wins

- Always know your runway under different scenarios

- Create consistent, honest reporting with a steady rhythm and clear format

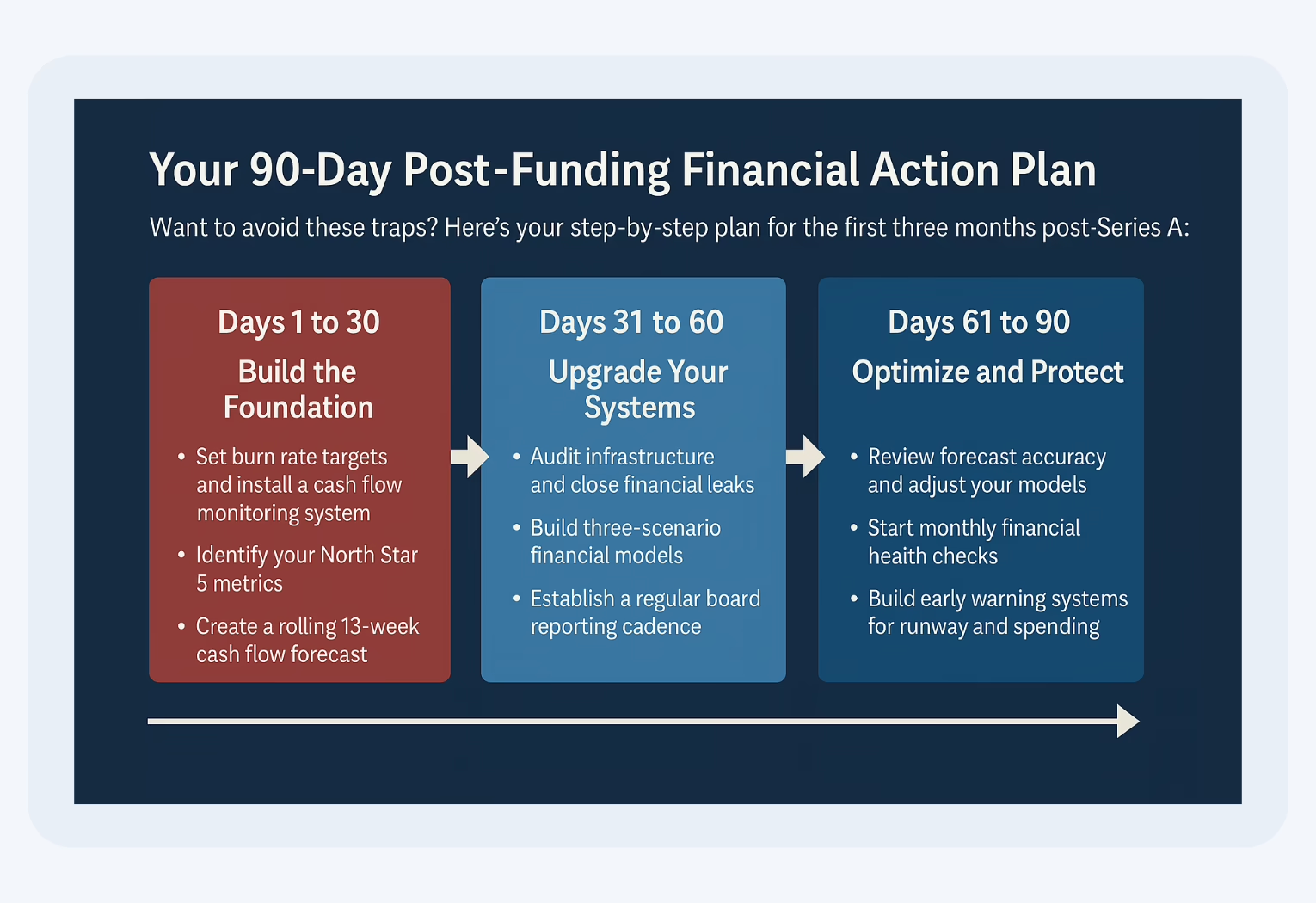

Your 90-Day Post-Funding Financial Action Plan

Want to avoid these traps? Here’s your step-by-step plan for the first three months post-Series A:

Days 1 to 30 Build the Foundation

- Set burn rate targets and install a cash flow monitoring system

- Identify your North Star 5 metrics

- Create a rolling 13-week cash flow forecast

Days 31 to 60 Upgrade Your Systems

- Audit infrastructure and close financial leaks

- Build three-scenario financial models

- Establish a regular board reporting cadence

Days 61 to 90 Optimize and Protect

- Review forecast accuracy and adjust your models

- Start monthly financial health checks

- Build early warning systems for runway and spending

The CFO Services Advantage

What separates startups that succeed from those that don’t? It’s not just product or team. It’s real financial leadership. And you don’t need a full-time CFO before you’re ready.

CFO services give you:

- Strategic financial oversight

- Board-ready reporting

- Scenario planning tied to cash flow

- Forecast accuracy that builds investor confidence

Startups with CFO services are more than twice as likely to raise a successful Series B.

At Adventum, we’ve helped over 100 startups transform financial chaos into strategic clarity. Ready to take the next step? Schedule a financial review and build your roadmap for growth.