Burn rate is the rate at which a startup uses its cash reserves to cover expenses before reaching profitability. It’s a critical financial metric that determines how long a startup can operate before needing additional funding or becoming cash-flow positive.

This article covers how to calculate your burn rate, why it matters to founders and investors, and practical strategies to reduce it without slowing growth.

What Is Burn Rate?

Burn rate refers to how quickly a startup depletes its cash reserves each month to fund operations. It helps determine how long a company can survive without new revenue or funding.

The formula to calculate burn rate is:

(Beginning Cash – Ending Cash) ÷ Number of MonthsThis metric is essential for understanding your startup’s runway and financial sustainability.

You’ve wrapped up your startup investment round. The champagne is popped and flowing, and your team is buzzing with motivation. But before you hand out raises or double the headcount, ask yourself: How long will this startup runway really last?

Almost 70% of startups exhaust their finances within three years. Without effective cost measures, even the most propitious ventures can risk sustainable success. These early missteps often stem from avoidable financial traps that can be caught and addressed early with the right financial oversight.

While you’re prioritizing growth and fundraising, a sneaky little metric called burn rate can creep up on you quickly if you’re not paying attention.

To keep your startup running smoothly, ensure you have sufficient funds to cover operational costs. Reducing burn rate significantly extends your runway, giving your venture more time to achieve profitability and reach its next milestone.

Burn rates reveal valuable insights into identifying areas where you can rein in spending and startup cash flow without hindering performance and growth.

The Basics: What Is Your Startup’s Cash Burn Rate?

Burn rate refers to the rate at which a startup spends its cash reserve before generating positive cash flow or becoming profitable. This metric is generally conveyed as a per-month rate, such as “XYZ Startup has a $30,000 monthly burn rate.”

Key components of a company’s burn rate calculations include:

- Gross Burn Rate: This represents your total monthly cash outflow (expenses), including employee salaries, marketing costs, rent, and utilities.

- Net Burn Rate: Your net burn rate encompasses both cash inflow (revenue) and outflow. This metric is calculated by subtracting revenue from total expenses and indicates the amount of money your startup loses every month.

- Cash On Hand: The amount of funds your startup has at the beginning of the period.

- Cash Runway: The estimated time (typically in months) a startup can operate at its current burn rate before running out of money. The cash runway is calculated by dividing the cash on hand by the net burn rate per day.

To calculate your startup’s cash burn rate, start by subtracting your ending cash balance from the beginning cash balance over a specific period and then divide by the number of months.

The burn rate formula is: (Beginning Cash Balance – End Cash Balance) ÷ Number of Months.

For instance, if XYZ Startup starts the month with $150,000 and ends with $90,000 after three months, the gross burnout is ($150,000 – $90,000) / 3 = $20,000 per month.

Why Tracking Cash Burn Rate Is Crucial

Managing cash burn rate is critical because it shows how long your company can sustain operations with its current reserves.

Some of the top reasons to track burn rates include:

- Determining financial runway

- Informing fundraising decisions

- Attracting investors

- Guiding cost management

- Enabling financial freedom and reducing stress

- Ensuring long-term sustainability

- Enhancing operational efficiency

Almost 30% of startups fail because they run out of money. Many of these failures stem from cash flow problems that fractional CFOs are uniquely equipped to solve. Tracking burn rate ensures your business not only remains afloat but also becomes profitable.

Managing Your Cash Burn Rate Without Compromising Growth

Use these tips to manage your burn rate while fueling business growth efficiently.

Be Realistic with Your Scorecard

One hurdle that founders consistently face is dissonance between their plans and reality. Perhaps during fundraising, you projected $100,000 monthly recurring revenue (MRR) in 12 months. But real-world growth follows zig-zag curves. Things take longer, and costs creep higher.

To tighten the gap:

- Adjust for Increased Quotient: Multiply plans and models by +20% to 30% to account for the inevitable surprise costs.

- Use Rolling 12-Month Forecasts: Update your model on a monthly basis to ensure accuracy. If Q1 went off the rails, you’ll have time to react.

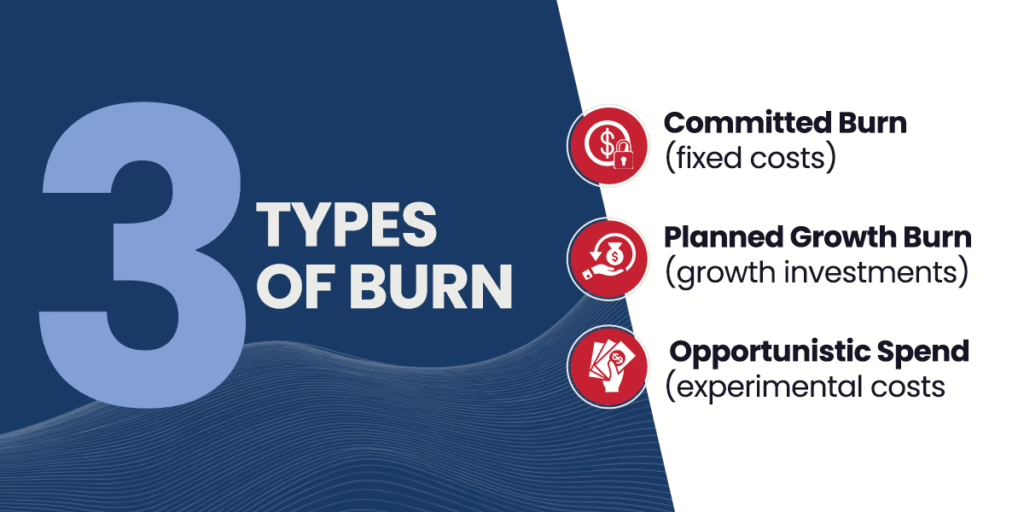

Three burn metrics to track are:

- Committed Burn: Recurring fixed costs

- Planned Growth Burn: New hires or one-time expenses tied to growth

- Opportunistic Spend: Experimental marketing or strategic initiatives

By breaking it down this way, you can make surgical adjustments rather than making drastic changes all at once.

Cost Management Doesn’t Kill Growth

A common startup myth is that cutting costs equates to burning growth. However, that’s not always the case.

When you smartly reduce burn, you get more time to hit milestones. To do this:

Prioritize ROI and NRR

Re-evaluate each expense with two questions:

- Will this bring net revenue or product-led growth?

- Is this accelerating customer acquisition or retention?

For example, if you pay $5,000 per month for a tool used infrequently, scrap it. That’s nearly $60,000 per year, which is enough for a full-time hire.

Focus on Variable, Not Fixed

Fixed costs, such as rent and salaries, are harder to scale down quickly. Variable costs, like ad spend, freelancers, and events, are agile.

Audit Tools Quarterly

Walk down your stack war story:

- What modules are underutilized?

- Can we renegotiate or switch plans?

- Are there internal, open-source, or bundled alternatives?

Create “Burn Flexibility” Plans

Having a runway cushion is comforting. But strategic flexibility is more powerful.

If metrics hit or exceed targets, you could unlock:

- Triggered funding draws

- Performance-based bonuses or referrals

- Expansion into new markets

If growth is slower than forecast:

- Implement a selective hiring freeze

- Scale back non-essential spend

- Freeze ad budgets until channel performance is clarified

- Reallocate roles and responsibilities internally to close gaps

It’s essential to communicate clearly with your team why you’re tightening now. Transparency deepens trust.

Reduce Burn Without the Headache

Take practical steps to avoid dramatic layoffs:

Cut Low-Impact Marketing

If X% of marketing channels underperform, pause and optimize them.

Streamline Your Stack

Audit everyone on your team:

- Could you move from weekly meetings to monthly tool reviews?

- Can someone else operate this expensive feature?

Renegotiate Everything

Landlords, agencies, and service providers expect you to ask. Don’t skip this. It’s easier now than when the runway is tight.

Use Fractional Roles

Remote or fractional hires can save 40% to 60% on labor costs while promoting workforce flexibility. Engaging interim CFO services is one way to access senior financial leadership without long-term cost.

Revisit Compensation Mix

Consider swapping a cash bonus for equity vesting or shifting hiring to performance-based milestones.

Invest at the Right Time

Reducing burn doesn’t mean growth stops. To invest wisely look for ways to boost profitability through smarter financial decisions without overextending spend:

- Limit top-of-sector ad tests to four-week bursts. Keep a “learn vs scale” cadence.

- Leverage local events and partnerships. These are often underpriced and deeply targeted.

- A customer success hire can deliver better ROI than adding another lead-gen channel.

Restart or Relaunch?

You don’t always need a restart. Sometimes, you need a reboot.

When the burn climbs faster than growth:

- Pause discretionary spend.

- Huddle your leadership around cash speed.

- Revalidate key metrics, such as the activation rate or loan-to-value (LTV) ratio.

- Cut or pivot a non-core project, not the whole product.

You’ll be surprised how often targeted tweaks bring back runway and results. Use those one to two extra months to build traction or position for your bridge round.

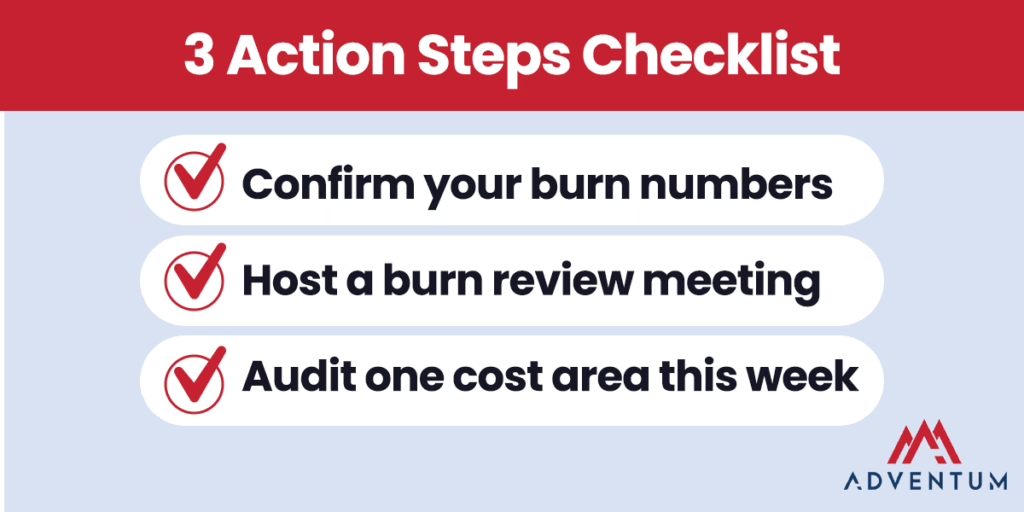

3 Action Steps to Start Today

- Close all your books, ensure your burn is accurate, including all new hires and tools.

- Host a “burn review” meeting now, not six weeks from now. Update your runway and build Plan B.

- Audit one cost area this week. Marketing spend? Office lease? Renegotiate, reassign, or retreat.

Do that every 30 days. This can transform your burn from a liability into a leading indicator of growth and control.

Managing Cash Burn Rates: Your Next Move

Set aside 30 minutes this week to run your first “burn review.” Bring your finance leader or trusted advisor. Make it part of your regular rhythm.

Adventum is here to support your journey because funding is just one step. The smart path ahead starts with understanding your burn rate, optimizing resources, and doubling down on what works. We’ve helped over 100 startups get their burn rate under control.

Here’s the next chapter of your story, calculated, controlled, and on your own terms. Reach out today to learn more.

Frequently Asked Questions

Q: What’s a reasonable burn rate for a Series A startup?

A: A reasonable monthly burn rate for a Series A startup typically ranges around $200,000 per month for seed-stage startups. However, your burn rate will vary depending on your team size, growth goals, and market conditions. Startups should aim to maintain 12 to 18 months of runway based on their net burn rate.

Q: How do I calculate runway after a funding round?

A: To calculate startup runway after a funding round, divide your total cash on hand by your monthly net burn rate. For example, $3 million/$250,000 = 12 months’ runway.

Q: When should I start worrying about my burn rate?

A: Startup founders should start monitoring burn rate closely when expenses increase without matching revenue growth, runway is rapidly shortening, the company becomes overly dependent on future fundraising, or when your burn rate no longer aligns with your business goals. These are key signs that your burn rate may be unsustainable.