Startup financial forecasting is the process of projecting a company’s future revenue, expenses, and cash flow based on historical data, current plans, and logical assumptions. It helps founders make strategic decisions, manage burn, and build investor confidence.

| At a Glance – Post-Series A financial forecasting requires: – Monthly cohort-based revenue modeling to track growth trends – 18-24 month cash flow projections to manage runway – Scenario planning (base/best/worst) to prepare for change – Board-specific KPI dashboards for investor reporting – Quarterly reforecasting cadence to maintain accuracy |

Let’s be real. There’s nothing quite like the nerves of your first board meeting after closing a Series A.

You’ve raised the capital. You’ve got the vision. You walk into the boardroom ready to crush it.

And then someone asks:

“So, walk us through your forecast for the next 18 months.”

Cue the awkward pause.

Suddenly, all eyes are on your spreadsheet, and it’s clear the numbers aren’t adding up. You’re not alone. Over 82% of startups fail due to poor cash flow forecasting and management. The cold, hard truth? Investors can tell if you’re struggling.

Unfortunately, we’ve seen this play out numerous times with Series A companies. Founders are brilliant builders, but startup financial forecasting doesn’t come naturally to most. That Excel model that got you through seed will not satisfy a board that includes institutional investors. But mastering your ability to project and manage your financial future is one of the smartest moves you can make post-raise.

In this post, we’ll break down:

- What startup financial forecasting is, and why it matters now more than ever

- How to build forecasts that investors trust

- What to include in investor-ready models and what to avoid

- How often to update it

- The top forecasting mistakes founders make

- And how a fractional CFO can help you avoid them

Ready to take the first step to a brighter financial future? Let’s dive in.

What Is Startup Financial Forecasting, and Why Does It Matter After You Raise?

Think of financial forecasting as your company’s best guess about the future, grounded in reality. It’s the process of projecting your revenue, expenses, and cash flow over a set period (usually 12 to 24 months), based on historical performance and plans.

Many founders confuse forecasting with budgeting, but they serve different purposes:

Budgeting is a fixed plan, like saying, “Here’s how much we’ll spend this year.”

Forecasting is more like, “Given what’s happening, here’s where we think we’re headed.”

Forecasting becomes especially critical post-Series A. Why?

Because now, with 20-75 employees and $500K+ monthly burn, you’re managing complex deferred revenue, planning hiring across multiple departments, and making decisions that impact runway. Your investors expect you to allocate their capital wisely and be able to explain how and why those decisions are being made — and they want those updates monthly, not quarterly.

Solid financial modeling for startups helps you:

- Spot cash gaps before they become crises

- Time your next fundraise strategically

- Hire with confidence

- Build trust with your board

Financial forecasting is crucial for startups because it helps founders:

- Set realistic goals and milestones

- Enhance decision-making

- Let lenders and investors evaluate your potential profitability and make confident funding decisions

- Avoid liquidity problems by better anticipating outflows and inflows

- Mitigate risks by pinpointing challenges and opportunities in advance

How Do You Build a Financial Forecast That Investors Trust?

This is where many founders get tripped up. You can’t just throw numbers on PowerPoint and hope for the best.

Here’s what trustworthy forecasting looks like:

Use Historical Data and Logical Assumptions

Start with what you do know,—your past revenue, expenses, and customer metrics. Then, build forward-looking assumptions based on actual performance. Don’t guess. Don’t hope. Be logical.

Build Both Top-Down and Bottom-Up Views

A top-down forecast starts with market size and narrows into revenue goals. A bottom-up forecast starts from your actual capabilities: how many sales reps, how many leads, what conversion rate.

Investors want to see both, and they should match up.

Ground Your Projections in Reality

Yes, you might be over-optimistic about your startup’s success, but investors want grounded, conservative estimates backed by data. Use expense projections and insights from industry reports, competitor data, and market analysis to support your startup projections.

Use Three-Scenario Forecasting

We always recommend building best-case, base-case, and worst-case scenarios. This shows maturity and realism, and it prepares you for volatility.

These tell you how profitable your revenue is. For a SaaS company, COGS might include hosting or support. For DTC brands, it’s the product and shipping.

Align Forecasts with Strategy

Make sure your forecasts support and align with the goals, milestones, and outlines in your overall business plan.

When your forecast mirrors your business model logic, it builds confidence. Roughly 61% of successful businesses use forecasting to realign with their strategic goals continuously. Make this a quarterly practice to stay relevant.

What Should Your Startup Financial Forecast Include?

A great forecast isn’t just about revenue. It tells a complete story that connects the numbers to your growth strategy.

Revenue

Break down your revenue by type: product, service, subscriptions, or recurring vs. one-time. For SaaS, show MRR waterfall, logo churn vs. dollar churn, and expansion revenue. For healthcare companies, separate pilot revenue from contracted ARR. Don’t lump it all together. Investors want to see what’s driving growth.

Cost of Goods Sold (COGS) and Gross Margin

Operating Expenses

These are your day-to-day costs, including marketing, office space, software tools, and legal. Forecast these carefully, as they can balloon quickly.

Hiring Plan and Payroll

One of the biggest post-Series A expenses is talent. As you scale from 25 to 75 employees, map out your hiring plans by role and timing. Show how each hire impacts burn rate and when they are expected to contribute to revenue or operational milestones.

Cash Flow and Runway

Even if your revenue looks great, if cash comes in late or expenses spike early, you could run out of runway. Forecasting cash flow timing is critical.

Check out our guide on cash flow strategies to extend runway for more expert guidance.

Fundraising Assumptions

If you’re planning another raise, your forecast should clearly show when and how much you’ll need. You should also model different scenarios to stay ahead of the curve.

Some best practices for developing a startup financial forecast are:

- Basing your projections on solid research, realistic assumptions, and industry benchmarks

- Regularly review and update your projections

- Seek expert guidance

How Far Out Should You Forecast, and How Often Should You Update It?

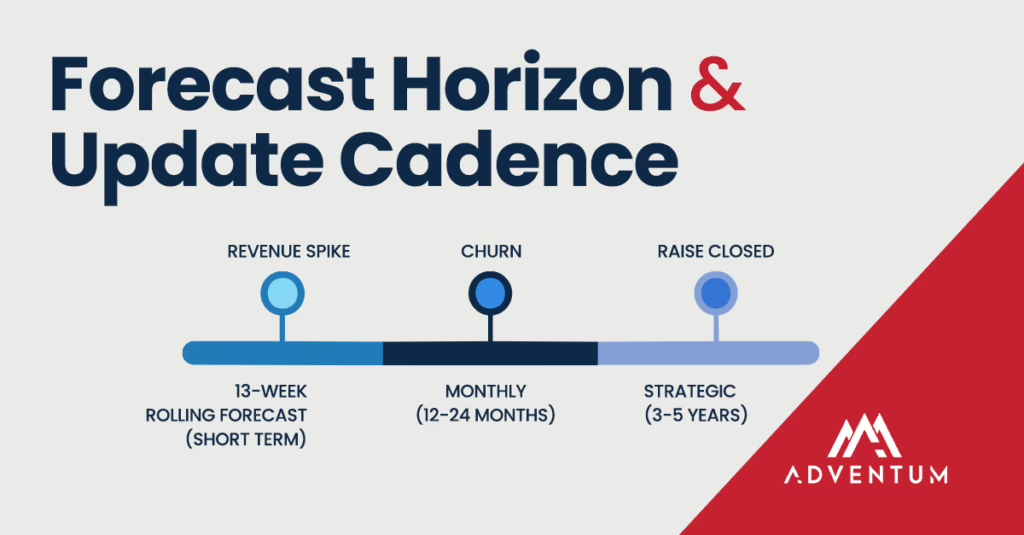

Forecast Horizon: 12 to 24 months is the sweet spot. Investors want to see how you’ll use their capital, and what that gets you over one to two years. For strategic planning, it should ideally be three to five years.

Granularity: Monthly forecasts are standard, but don’t forget to include a rolling 13-week cash flow forecast. This gives you a pulse on short-term liquidity, which is a lifesaver if things get tight.

Keep in mind that the frequency of updates depends on your business’s stage and market volatility. Early-stage startups or those in turbulent environments should update their forecasts monthly or quarterly.

Regardless of your schedule, any changes in business performance or market conditions should trigger you to update your forecast immediately.

These triggers include:

- Revenue growth accelerates, or stalls

- You close a round or take on debt

- You change your hiring plans

- Big customers churn

- You decide to pivot or launch something new

Forecasts are living documents. Revising them regularly is a sign of leadership, not weakness.

What Are the Biggest Mistakes Founders Make in Startup Forecasting?

Even the best founders are bound to stumble. A few common traps to keep an eye out for include:

Overestimating Revenue Growth

It’s tempting to paint the rosiest picture. But if you’re predicting five times growth with no historical proof, investors will see through it.

Over 95% of startups never reach their initial projections.

Underestimating Expenses

Salaries, software costs, and legal fees add up quickly. And many founders forget to budget for hiring lag, which delays execution. A whopping 82% of small businesses fail due to cash flow issues.

Ignoring Payment Delays

Revenue does not equal cash. Just because a customer signs a deal doesn’t mean the money hits your bank right away. Timing matters.

Failing to Update Their Model

Treating financial modeling as a one-and-done activity leads to decisions based on outdated information. Surprisingly, 87% of finance execs reported their forecasts are outdated when presented.

Not Planning for Downside Scenarios

Things don’t always go as planned. Build a model that can weather storms, not just one that shines in ideal conditions.

If you need a quick refresher on risk after a funding round, take a look at Five Startup Traps You Can Avoid with CFO Services.

How Can a Fractional CFO Help You Build and Maintain Forecasts?

Forecasting takes time, skill, and objectivity, three things most founders are short on.

Luckily, fractional CFOs, like the ones at Adventum, can step in to help.

Outside Objectivity

We’re not emotionally tied to the business. That means we can question assumptions, identify blind spots, and bring discipline to the model.

Alignment with Investor Expectations

We’ve been in the boardroom. We know what VCs want to see and how to present it. A fractional CFO bridges the gap between founder vision and investor reality.

Forecast Hygiene

It’s not just about building a forecast once. It’s about creating a cadence: regular updates, consistent formatting, clear KPIs. We make forecasting a system, not a scramble.

Real Results

At Adventum, we’ve helped dozens of startups build investor-grade forecasts that unlocked follow-on funding, extended runway, and enabled smart hiring at scale.

Learn from one real-world example of how we helped a client develop a clear, detailed financial model for investors to drive stakeholder approval and investor interest.

We don’t just crunch numbers. We help you tell your financial story with clarity, confidence, and credibility.

Your Forecast Is More Than a Spreadsheet, It’s Your Story

Forecasting isn’t just about numbers. It’s about vision, accountability, and leadership.

When you walk into that board meeting with a startup forecast template that’s thoughtful, grounded, up-to-date, and aligned with your goals, it sends a powerful message:

“I know where we’re going, and I have a plan to get us there.”

Treat forecasting not as a once-a-quarter chore, but as a muscle you build. It will make you a better leader, a stronger storyteller, and a more trusted steward of capital.

Ready to Build Forecasts That Work?

If you’re a founder who’s ready to get serious about your numbers, we’re here to help.

Book a financial review with our CFO team and let’s build a forecast your investors and team can believe in.