Post-seed founders face a bandwidth trade-off. Building board-level financial models competes directly with the strategic work only they can do. This article explains why those expectations change after a raise and how founders solve the problem without sacrificing execution.

Post-seed founders face a bandwidth trade-off: building sophisticated financial models for board presentations competes directly with the strategic work only they can do. The solution is fractional CFO support to build financial infrastructure while preserving founder time for core business strategy.

The Post-Raise Inflection Point

Robert Sofia had just closed a $3.5M seed round for Snappy Kraken, his FinTech marketing platform for financial advisors. The company had won awards. The growth trajectory was strong. And then came the ask from his board: “Map multiple realistic growth scenarios for our review.”

He knew what they needed. He understood the value of sophisticated financial modeling. But he also knew something else: Time constraints would limit his ability to fully develop what he envisioned.

This is the inflection point most post-seed founders hit: You just raised capital to extend runway, but building board-level financial projections competes directly with the strategic work only you can do.

How Board Expectations Change After a Venture Capital Funding Round

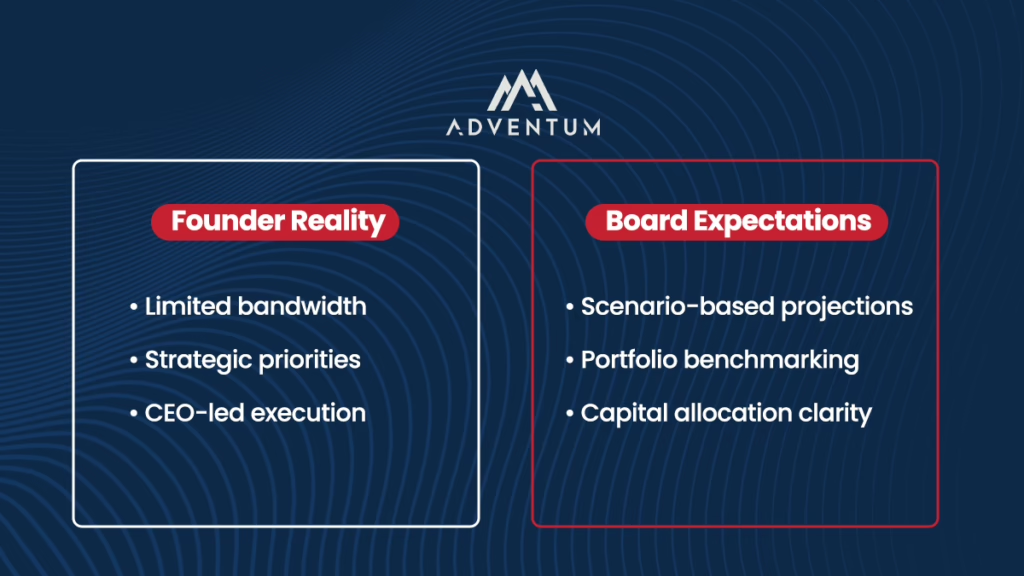

After closing a meaningful round, your board stops tolerating rough projections and starts expecting scenario-based analysis.

Pre-raise, investors bet on your vision. Post-raise, they manage portfolio risk. That means they need to see:

- Multiple realistic growth scenarios (not just your base case)

- Detailed financial reports that demonstrate consistent growth

- Key financial indicators and metrics that let them assess your trajectory against their portfolio benchmarks

The companies that get this right don’t just satisfy their board—they use financial modeling as a decision-making tool that empowers them to make data-backed decisions about capital allocation.

After a raise, boards shift from vision to risk management, making navigating investor relations after funding a core finance responsibility.

The Time vs. Sophistication Trade-Off for Tech Founders

Robert’s challenge wasn’t lack of financial knowledge—it was bandwidth. Post-raise, founders face a brutal trade-off:

Option A: Spend 60-90 days building the financial model yourself

→ Result: You get the model, but you miss the window for strategic initiatives that actually drive growth

Option B: Hire a full-time finance executive prematurely

→ Result: You add permanent headcount before you’ve validated what financial infrastructure you actually need

Most post-seed companies don’t need a permanent finance executive—they need fractional CFO services to build board-ready financial infrastructure without sacrificing founder bandwidth.

What Board-Level Financial Projections Actually Require

When Robert engaged Adventum, the deliverable wasn’t bookkeeping. It was freeing the CEO to work on business tactics and long-term strategy while the financial infrastructure got built in parallel.

Specifically, Adventum’s approach:

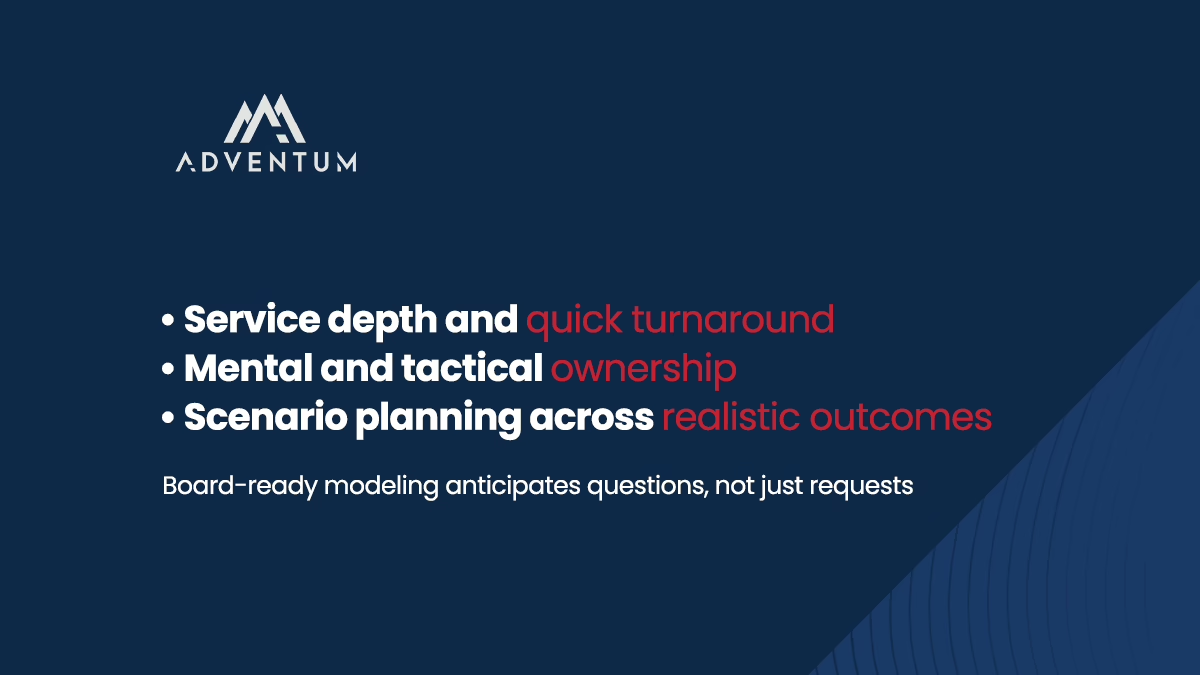

- Service depth and quick turnaround: Built the financial model without requiring the CEO to context-switch between strategic work and spreadsheet architecture

- Mental and tactical ownership: The team took ownership of the financial modeling process, not just execution, meaning they anticipated what the board would ask for, not just what the founder requested

- Scenario planning: Delivered an accurate range of scenarios for board presentation—not a single projection, but multiple realistic paths

The result: Robert could tell his board, “Here are our growth scenarios,” while spending his time on the core business strategy that would deliver those scenarios.

Board-level projections aren’t just spreadsheets—they’re a signal that you’re building a scalable finance function capable of supporting the next stage of growth.

Why Financial Modeling Is a CEO Leverage Tool

Most founders treat financial modeling as a compliance exercise. The actual insight: Sophisticated financial modeling is what lets you communicate value to stakeholders while keeping your time focused on the strategic work that creates that value.

Robert’s quote tells the story: “Adventum’s sophisticated modeling allowed us to focus on core business strategy.”

Translation: The ROI of fractional CFO support isn’t just “cleaner financial reports”—it’s CEO time redirected from spreadsheets to the strategic initiatives that position the company for its next funding round.

This is why Snappy Kraken’s engagement led directly to being “positioned for a second round of funding.” It wasn’t just about having better numbers—it was about having the bandwidth to execute the strategy those numbers represented.

When Post-Seed Founders Need Financial Modeling Support

The need for sophisticated financial modeling hits immediately after a funding event, when “transparency to welcome next-level investor interest and scrutiny” becomes mission-critical.

If you’re post-raise and your board is asking for “multiple realistic growth scenarios,” you’re at a decision point.

The companies that successfully navigate this don’t try to do it alone. They recognize that building financial infrastructure is specialized work that delivers maximum ROI when it doesn’t consume the founder’s strategic bandwidth.

The Bottom Line for Post-Seed Founders

Snappy Kraken’s case shows the actual value proposition of fractional CFO support: It’s not about outsourcing finance—it’s about preserving founder bandwidth for strategic work while ensuring your board gets the financial analysis they need to support your next stage of growth.

The metric that matters: Can you walk into your next board meeting with detailed financial scenarios without having spent the last 90 days building them yourself?

If the answer is no, you’re facing the same trade-off Robert faced: sophisticated financial modeling vs. strategic execution time.

The companies that win choose both.

FAQ: Financial Modeling for Post-Seed Founders

What do boards expect after a seed round?

Post-raise, boards expect multiple realistic growth scenarios, detailed financial reports demonstrating consistent growth, and key financial indicators that let them assess your trajectory against portfolio benchmarks. Rough projections are no longer sufficient.

Should I hire a full-time CFO after raising a seed round?

Most post-seed companies don’t need a permanent finance executive—they need 60-90 days of financial infrastructure buildout. Hiring full-time adds permanent headcount before you’ve validated what financial infrastructure you actually need.

How long does it take to build board-ready financial projections?

With fractional CFO support, financial infrastructure buildout—including scenario planning, detailed reporting, and key metrics—can be completed in 60-90 days without consuming founder bandwidth.

What’s the ROI of fractional CFO support post-raise?

The ROI isn’t just cleaner financial reports—it’s CEO time redirected from spreadsheets to strategic initiatives. Snappy Kraken’s engagement led to being “positioned for a second round of funding” because the CEO had bandwidth to execute strategy.

When should a post-seed founder bring in financial modeling support?

The trigger is when investor scrutiny increases—typically immediately after a funding event—and your board asks for “multiple realistic growth scenarios” that your current bandwidth can’t support.

What did Snappy Kraken’s engagement with Adventum deliver?

Adventum provided financial modeling with service depth and quick turnaround, took mental and tactical ownership of the process, and delivered an accurate range of scenarios for board presentation. CEO Robert Sofia reported: “Adventum’s sophisticated modeling allowed us to focus on core business strategy.”